Rs 10 lakh crore, is required in circulation in the markets-Finance India Summit

Inclusive Finance India Summit was inaugurated on 5 December 2016 at the The Ashok Hotel, New Delhi. The Summit seeks to build consensus on strategies and help in building a unified vision for achieving universal financial Inclusion in India. The summit across the two days, in 15 sessions, 118 thought leaders from across the world will discuss, deliberate and debate on key challenges and factors that advance or impede financial inclusion in the country.

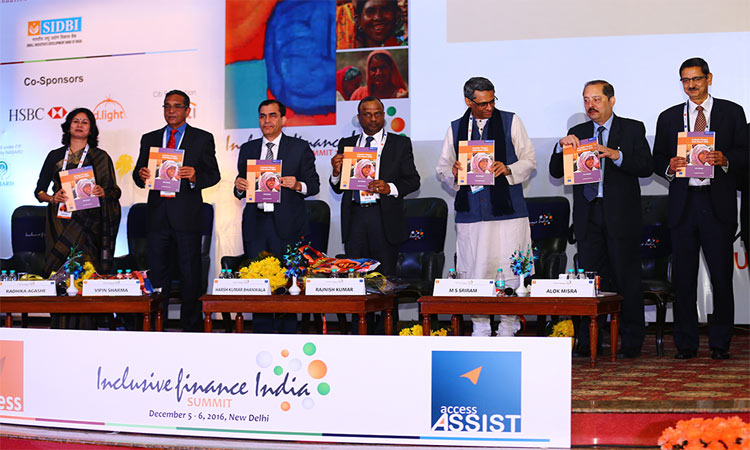

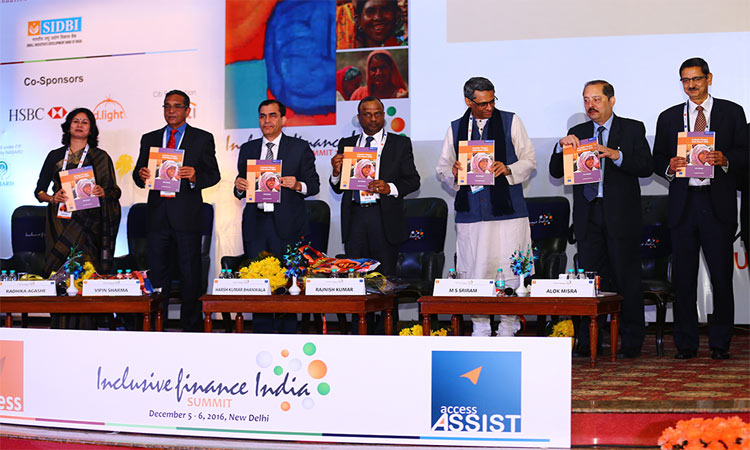

Mr Vipin Sharma, CEO Access Development Services, welcomed the delegates to the inclusive finance India summit and thanked all stakeholders for supporting and contributing to the summit. Two important reports by Access– The Inclusive Finance State of the Sector Report by Prof M S Sriram and The Responsible Finance India report by Dr Alok Misra were released in the inaugural session.

Mr Rajnish Kumar, Managing Director of State Bank of India emphahsied the need to reduce cash component in money supply and that in order to reduce transactions costs, digital mode of transactions was the only way forward. He said, “Post de-monetization our deposits have exceeded Rs1 lakh crore in savings account from November 8 till date” He also said that Deposits are not an issue. The agenda for the next 3-4 months is to look at ways to increase our loaning and digitisation of banking operations.

Dr Harsh Kumar Bhanwala, Chairman NABARD, said “With proliferation of technology there was need to have a rethink on laws related to consumer protection and grievance redressal framework for digital transactions.” He also said that there was also need to have a graduated training and certification framework for the Business Correspondents to increase their effectiveness.

The first plenary discussed whether efforts on financial inclusion including the PMJDY made expected progress. Millions of bank accounts were opened under PMJDY and ventured into discussing whether the access to finance had translated into actual usage. The panel discussed that for a long time people have been accustomed to the use of informal sources of finance and accessibility was one of the main reasons for non-usage of formal financial sources. The session further delved on the importance of establishing proper infrastructure and technology to ensure higher utilization of financial services. Mr. Porush Singh, Mastercard said, “Building up infrastructure and providing low cost service was a key towards providing financial inclusion”.

Panelists emphasised that banks alone could not ensure the task of universal financial inclusion given their limited outreach. Mr Rajnish Kumar of SBI said, “BCs can reduce up to 70% of the transaction costs of the bank; however, for this to happen, it is important to provide proper training and ensure availability of a range of products through the BC channel”.

The second plenary debated on the issues related to multiple borrowings and client over indebtedness, with growth in the industry, the issues of multiple borrowings and client over-indebtedness has gained importance. Results of a study by IFMR on the extent and drivers of over indebtednes were presented which found that 23% of the MFI clients in the sample were over indebted. The study also found that the drivers of over-indebtedness include low of unstable income, multiple borrowings, high loan sizes, poverty levels, use of loans and cross borrowings.

Dr Alok Misra, author or the Responsible Finance India report said, “The analysis of data suggested that the problem of overindebtedness is not universal but was concentrated in certain pockets.”

During lunch, Voices of Clients report commissioned by DFID and PSIG was released. The report presented feedback and concerns of the clients on the practices of MFIs.